Blog

FAQ (English version) on special deduction for the renovation cost under P.U. (A) 381/2020

FAQ on special deduction for the renovation cost under P.U. (A) 381/2020 (Updated on 11.03.2021)

Expenses incurred (between 1 March 2020 to 31 December 2020) to renovate/refurbish (R&R) the business premises for business purpose are given tax deduction up to a limit of RM300,000.

1. Who is eligible?

To be eligible to claim for tax deduction, shall be subject to the following conditions:

- Any taxpayer who incurred an expense of R&R on business premises.

- The business premises are used for the purpose of its business.

- Deduction is given on the adjusted income under paragraph 4 (a) of the Act Income Tax 1967

2. What is meant with the premise business for this purpose?

All the business premises are either owned or rented by the taxpayer and the premises are used for the purpose of business is eligible.

Example:

(a) Mr. Vincent is the owner of a homestay in Bagan Lalang. During the Movement Control Order (PKP) 2020, Mr. Vincent has costs incurred of R&R on homestays. Expenses of R&R performed by Mr. Vincent for the period of 1 March until 31 December 2020 is eligible for a deduction under P.U. (A) 381/2020 in determining income adjustment of his homestay business for the year of assessment 2020 is subject to the conditions set.

(b) Mr. Rahim rented a shop house for running a restaurant business. During the period Movement Control Order (PKP), the restaurant business was temporarily closed and Mr. Rahim has costs incurred of R&R. Expenses of R&R done by Mr. Rahim is eligible for deduction in determining the income of its subject business to the conditions prescribed under P.U. (A)381/2020.

(c) Hijras Arkitek Sdn Bhd provides services of architectural consultant and has an office in Petaling Jaya. In March 2021, the office has costs incurred of R&R i.e. installing carpets in his office. Hijras Arkitek Sdn Bhd is eligible deductions in determining the income of his business subject to the conditions set out under P.U. (A) 381/2020.

3. What are the eligible and not eligible cost of R&R?

Expenses eligible for tax deduction in the First Schedule P.U. (A) 381/2020:

- General electrical installation

- Lighting

- Gas system

- Water system

- Kitchen fittings

- Sanitary fittings

- Door, gate, window, grill and roller shutter

- Fixed partitions

- Flooring (including carpets)

- Wall covering (including paint work)- False ceiling and cornices

- Ornamental features or decorations excluding fine art

- Canopy or awning

- Fitting room or changing room- Recreational room for employee

- Air-conditioning system

- Children play area

- Reception area- Prayer Room

All the cost involved must be certified by external auditors.

Not eligible costs of R&R are in the Second Schedule P.U. (A) 381/2020:

- Designer fee

- Professional fee- Purchase of antique (purchase of an object or work of art which, represents a previous era in human society, is a collectable item due to its age, rarity, craftsmanship or other unique features and appreciates in value over time)

4. What is the external auditors?

External auditor means a qualified auditor who can confirm the cost incurred by the taxpayer on claims for renovation and renewal costs business premises under P.U. (A) 381/2020.

To be continued…..

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐚𝐭 𝐢𝐬 responsibility 𝐨𝐟 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Account/Payroll, Secretarial & Advisory)

𝐊𝐓𝐏 (Audit, Tax & Advisory)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

租金收入-税税问与答 Part 2

租金收入-税税问与答 Part 2

纳税人常问关于租金收入的tax问题 :

1.租金收入的税率%是多少?

2.为什么这么高 24%?

3.可以扣除assets?

4.亏损可以带到明年吗?

5.何时对租金收入征税?

Assets 资产

-

Business Income 4(a)

资本津贴可以用于工厂和机器的费用。

Capital allowances can be claimed on capital expenditure incurred on plant and machinery.

-

Investment Income 4(d)

不可以获得资本津贴,但替换家具和空调等家具的费用可以从租赁的总收入中扣除。

Capital allowance cannot be claimed, but cost of replacing furnishings such as furniture and air conditioner can be claimed as a deduction from gross income from that letting.

税收待遇 Tax Treatment

-

Business Income 4(a)

在最初的RM600,000 是17%的税率, 剩下的是24%的税率

First RM600,000 17% Remaining 24%,

-

Investment Income 4(d)

根据PR10/2015第8.2段,投资控股公司可以获得允许的费用如工资、薪金和津贴、管理费等。

Under paragraph 8.2 of PR10/2015, the permitted expenses are allowed by the investment holding company such as wages, salaries and allowances, management fees and etc

参考所得税实践笔记3/2020, 控股公司税率为24%,由2020课税年度起生效

Refer to Practice Note 3/2020, tax rate for investment holding company is 24% effective from year of assessment

根据PR 12/2018第11段, 建筑的拥有人可以获得工业建筑津贴,即使租赁是非商业来源,但建筑用于工业建筑

Under paragraph 11 of PR 12/2018, the owner of the building allowed to claim industrial building allowance even though the letting is a non-business source but the building use for industrial building

营业外收入4(a)变为营业收入4(d) Section 4(a) change to Section 4(d)

无权要求对不动产的设备和机器的资本免税额,因为它们在基本期结束时没有用于商业目的

Not entitled to claim capital allowance on the plant and machinery for the real property since they are not used for business purpose at the end of the basic period.

营业外收入4(d)变为营业收入4(a) Section 4(d) change to Section 4(a)

有权要求对不动产的设备和机器的获得资本津贴,因为它们在基本期结束时用于商业目的。合格费用是指在业务中使用的第一天的市场价值。

Entitled to claim capital allowance on the plant and machinery for the real property since they are used for business purpose at the end of the basic period.

The qualifying expenses is the market value on the first day used in the business.

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

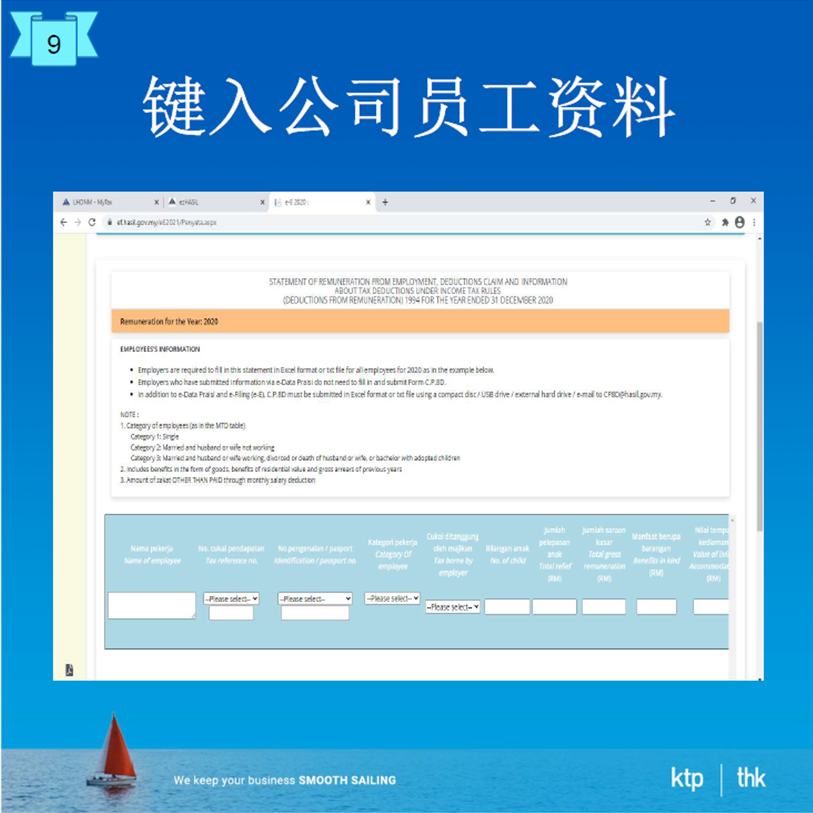

Form E 截至日期为31/03/2021

Form E 截至日期为31/03/2021

罚款

-

RM200至RM20,000

-

入狱少于6个月

-

或两者

温馨提示 -

KTP 只负责处理 Form C, CP204 并不包括Form E, 至于Form E的呈报, 你可以委任 我们的合作伙伴 THK.

谁需要呈报E 表格?

-

有限公司 - 不管是否有员工都必须呈交E 表格

-

合伙公司或个人经营公司 - 如果有员工,必须注册E号码并呈交E表格。

如何呈报E表格?

-

有限公司 - 必须在税务局的官网呈交

-

非有限公司 -

1. 填写E表格然后邮寄到税务局。或者

2. 在税务局的官网呈交(政府非常鼓励线上呈交)

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

KTP Lifestyle (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

THK (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Common traits of shadow director

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐚𝐭 𝐢𝐬 𝐜𝐨𝐦𝐦𝐨𝐧 𝐭𝐫𝐚𝐢𝐭𝐬 𝐨𝐟 𝐬𝐡𝐚𝐝𝐨𝐰 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐀𝐜𝐭 𝟐𝟎𝟏𝟔?

Share with us the other common traits of the shadow director in the comment section.

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Account/Payroll, Secretarial & Advisory)

𝐊𝐓𝐏 (Audit, Tax & Advisory)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Special Reinvestment Allowance 2020 - How/What to claim?

Overview of Special Reinvestment Allowance

An eligible manufacturing and agriculture company is entitled to claim Reinvestment Allowance (RA) and is to be deducted against the statutory income in the basic period for a year assessment.

However, how much is the entitle amount of RA to an eligible company? Any restriction to be applied on RA?

Key takeaways:

You will understand: -

1. The calculation of RA and deduction against statutory income.

2. Basic understanding of non-Application rule.

3. The documents to be prepared to claim RA.

Summary of learning:

1.Tax treatment of special reinvestment allowance

1. An eligible company is entitled to claim RA of 60% on the capital expenditure incurred the year of assessment (YA).

2. But, it will be restricted against 70% of statutory income. Any unabsorbed RA can be carried forward to next YA.

3. With effective from YA 2019, the unabsorbed RA can only be carried forward for a maximum of 7 consecutive years of assessment upon expiry of the qualifying period.

4. Any balance of unabsorbed RA after the end of that seven (7) consecutive years of assessment will be disregarded.

Example:

In YA 2020, ABC Sdn Bhd incurred a total capital expenditure of RM450,000.00 to increase its production capacity. The statutory income (SI) for the year is RM300,000.

How much is the RA claim by the company in YA2020?

Solution:

The tax treatment and calculation is demonstrated as follow:

- RA to be claimed by the company is RM270,000 (60% x RM450,000)

- However, it will be restricted to RM210,000.00 (70% x RM300,000 (SI))

∴ Therefore, the chargeable income to tax of the company in YA 2020 is RM90,000.00 (RM300,000 – RM210,000). The unabsorbed RA of RM60,000 (RM270,000 – RM210,000) will be carried forward to next YA.

2. Non-Application with Special reinvestment allowance

A company claiming RA is not able to enjoy the following tax incentives in the same year of assessment:

-

Pioneer status under the Promotion of Investments Act 1986 (PIA).

-

Investment tax allowances (ITA) under the PIA.

-

Incentive under Investment Incentive Act 1968 (IIA).

-

Industrial adjustment allowance under the PIA in respect of a manufacturing activity or a manufactured product (approval granted prior to the coming into operation of section 27 of the Promotion of Investments (Amendment) 2007 Act [Act A1318].

-

Group Relief for companies under section 44A of the Income Tax Act 1967 (ITA).

-

Deductions under any rules made under section 154 of the ITA.

-

Exemption from tax on income under exemption orders made under paragraph 127(3)(b) or exemption under subsection 127(3A) of the ITA.

3. Claim Procedures for Reinvestment Allowance

1. The eligible company is not required to apply or get written approval from Inland Revenue Board Malaysia (IRBM).

2. However, the company must prepare the RA claim form which can be downloaded from IRBM’s Official Portal.

3. The original copy of the RA claim form shall be kept by the company together with all relevant documents.

Sources:

-

Reinvestment Allowances Part 1 – Manufacturing activity:

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_10_2020.pdf

-

RA claim form:

http://phl.hasil.gov.my/pdf/pdfborang/BORANGTUNTUTANEPS_1.pdf

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

KTP Lifestyle (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

THK (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

who is director under the Company Act 2016

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐨 𝐢𝐬 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐀𝐜𝐭 𝟐𝟎𝟏𝟔?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

𝐊𝐓𝐏

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

租金收入-税税问与答 Part 1

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏纳税人常问关于租金收入的tax问题 :

1.租金收入的税率%是多少?

2.为什么这么高 24%?

3.可以扣除assets?

4.亏损可以带到明年吗?

5.何时对租金收入征税?

根据 IRB 公共裁决 Public Ruling第10/2015和第12/2018

如果屋主亲自或委任代理主动提供全面的维修服务 maintenance & support services 在物业上, 那么这个物业租金的收入将归纳于商业收入 (Section 4a business income)。

根据IRB 公共裁决 Public Ruling 第12/2018

如果屋主没有主动或委任代理提供全面的维修服务 maintenance & support services 在物业上, 那么这个物业租赁的收入将归纳于投资收入 (section 4d investment income)

问您 as 房东是否提供主动主动提供全面的维修服务 maintenance & support services 在物业上

If yes… business income

If no … investment income

资本津贴 capital allowance

-

Business Income 4(a)

本年度还没用完的的资本津贴可转至下一年课税年度

-

Investment Income 4(d)

本年度还没用完的的资本津贴不可转至下一年课税年度

业务亏损 Business Loss

-

Business Income 4(a)

允许使用未抵消的业务亏损在下一个课税年度的

-

Investment Income 4(d)

不允许使用未抵消的业务亏损到下一个课税年度的

营业日期 Commencement Date

-

Business Income 4(a)

这取决于房产第一次出租的日期 Depends on the date the real property is rented out for the first time

-

Investment Income 4(d)

这取决于房屋出租的日期 Depends on the date the real property is made available for letting

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Latest update on HRDF 2021

Latest update on HRDF 2021

Background of HRDF 2021

Gazette order PU (A) 84 * dated 26/02/21 which comes into operation on 1/3/21.

1. Employer with more than 10 or more employees

2. Employer for industry specified in column(2) of Part I of the First Schedule with 5 to 9 employees.

What is benefits of HRDF?

HRDF Levy is a fund that is deposited by employers on a monthly basis.

They can apply for schemes provided by HRDF to attend any programmes recognised by HRDF

The Government Special Fund is an allocation provided by the Government to benefit employers who apply for related schemes offered by HRDF.

What is HRDF rate ?

Section 14(1) of PSMB Act, 2001 stipulates that there shall be paid by every employer to whom the PSMB Act, 2001 applies, a HRD levy in respect of each of his employees at the rate of one per centum (1%) of the monthly wages of the employee.

Section 15(2) of PSMB Act, 2001 stipulates that there shall be paid by employer a HRD levy in respect of each of his employees at the rate of 0.5 per centum of the monthly wages of the employee (applicable to employer who opts to be registered).

An employer who is liable to pay the HRD levy shall pay those levies for the first and subsequent months’ wages commencing from the date the employer becomes liable as stated under the Regulation 7 of the Pembangunan Sumber Manusia Berhad (Registration of Employers and Payment of Levy) Regulations 2001.

The payment of the HRD levy is the responsibility of employers.

Employers are not permitted to deduct the wages of employees under any circumstances for the payment of the levy.

How to register HRDF?

1. Go HRDF website https://www.hrdf.com.my/

2. Click HRDF Employer Registration

3.Follow the procedures

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

特别自愿报税计划 U trun

马来西亚税收局 - 罚款

马来西亚税收局 - 操作准则3/2020

1. 目的

为了说明当纳税人无法依照《1967年所得税法令》第112(3) 条,《1967 年石油所得税法令》第51(3)条和《1976年不动产利得税法令》第29(3)条里所规定的时限内呈报税务报表,将被处以的罚款处分。

准则里的处分包括了:

-

逾期提交的罚款

-

如果未在期限内呈报税务报表,将被施以额外的税务

2. 税务申报的截止日期

以下是纳税人需要提交税务报表的截止日期:

-

就业或其他收入但不包含商业收入 - BE, B, P, BT, M, MT, TF, TP, TJ

4月30日 (无经营生意者)

-

商业收入 (独资企业、合伙企业)- BE, B, P, BT, M, MT, TF, TP, TJ

6月30日 (经营生意者)

-

公司(有限、有限责任合伙人(PLT)、信托机构、合作社)- C, PT, TA, TC, TR, TN, C1

公司财政年度结束后的7个月内

-

1976年不动产利得税法 - CKHT 1A, CKHT 1B, CKHT 2A

转让后的60天内

3. 逾期提交的罚款率

罚款率是根据逾期的时长来决定的

以下的罚款率是根据《1967年所得税法令》第112(3) 条:-

逾期时长

-

少于12个月 - 15 % 罚款率

-

12 - 24个月- 30 % 罚款率

-

超过12个月- 45 % 罚款率

以下的罚款率是根据《1976年不动产利得税法令》第29(3)条:-

逾期时长

-

少于12个月 - 15 % 罚款率

-

12 - 24个月 - 20 % 罚款率

-

超过12个月 - 25 % 罚款率

4. 税务局施予的额外税务

-

税务局有权对未提交税务申报的纳税人予以估计评估并给予处分

-

当之后实际申报表的税收大于税收局所给予的评估,税务局将会对额外的税务进行额外的税收罚款。

5. 估计评估的罚款率

法规

-

1967年《所得税法令》 - 45 % 罚款率

-

1976年《不动产利得税法令》- 25 % 罚款率

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

疫情当下,国库空虚 IRB 所得税 & SSM 商业注册局 捉什么?

时间: 10am - 12pm

IRB 所得税 & SSM 商业注册局

捉什么?

演讲者

Ms. Qiu Hui - Audit Manager

Ms. Chong - Tax Assistant Manager

Ms. Caroline - Account Assistant Manager

Ms. Lim - Corporate Secretary

* 此线上研讨会仅开放于KTP和THK客户。

Special Reinvestment Allowance 2020

Overview of Special Reinvestment Allowance 2020

Manufacturing and agricultural company are eligible for Reinvestment Allowance(RA) as long as the companies incurred qualifying costs for qualifying projects.

So what is “qualifying cost” and “qualifying project”?

Key takeaways:

You will understand: -

1. Qualifying projects

2. Qualifying costs

Summary of learnings:

A) Qualifying Projects:

Qualifying projects are Expansion, Modernization, Automation and, Diversification. Let me explain by simple illustration as below: -

1. Expansion - Increase of a production capacity

Illustration:

i) Company A increased production from 12,000 units to 20,000 units per month.

ii) Company B is a manufacturer of rubber gloves, which goes into the manufacturing of cotton gloves. [similar products but different materials]

2. Modernization - Upgrading of manufacturing equipment and processes

Illustration:

i) Company C acquire new machines to cut down the number of processes, production time, and manpower.

3. Automation - Change manual operation into mechanical operation

Illustration:

i) Company D invested in a robotic arm for packaging which was done manually previously.

4. Diversification - Produce additional or new related products relating to the same industry

Illustration:

i) Company B, a rubber gloves manufacturer goes into rubber shoes.

[same materials but different products]

B) What is the Qualifying Cost?

Capital investment incurred for the “qualifying activity” is eligible for reinvestment allowance.

Two types of Qualifying Cost:

i) Factory: New / Extension of factory

ii) Plant and Machinery: New machines use in the production (replacement are not allowed)

Exemptions

- Capital cost incurred by the director, staff, or third-party usage is exempted.

- Capital cost which is not incurred for production purpose

- The company already enjoys other tax incentives. (Such as tax incentives from Promotion on Investment Act 1986, Investment Incentive Act 1968, Group relief or others)

Sources: - Reinvestment Allowances Part 1 – Manufacturing activity:

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_10_2020.pdf

Stay tuned to our next ektp on “Requirements on documentations” and “Tax treatment” on Reinvestment allowance.

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

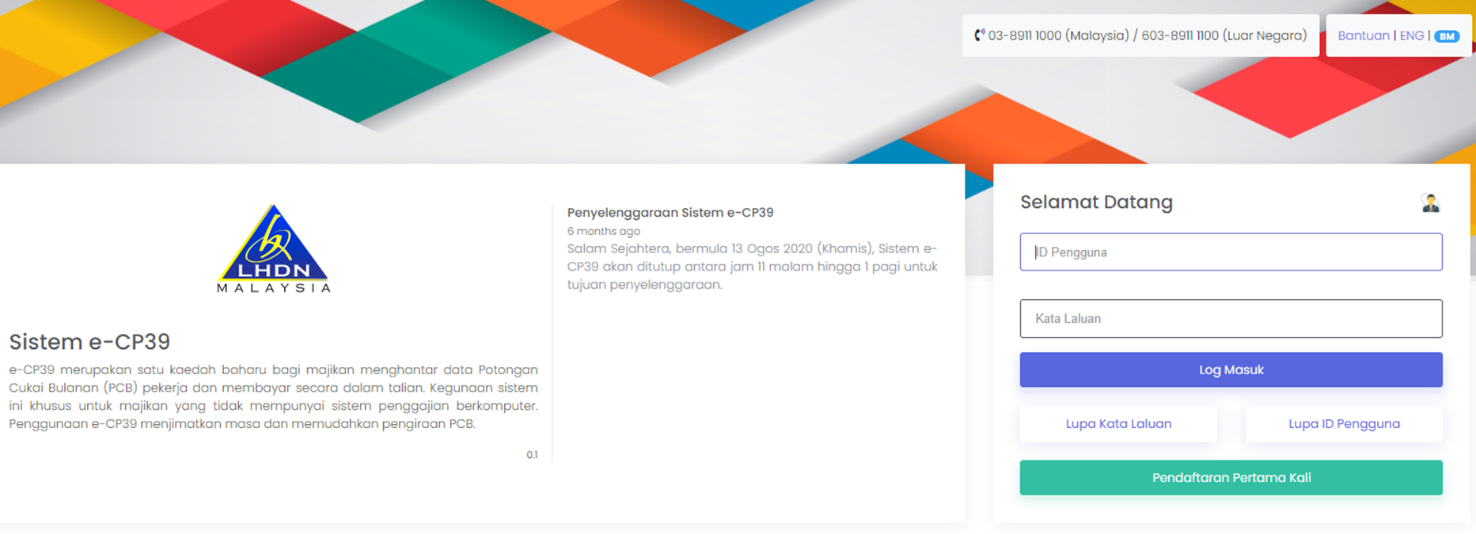

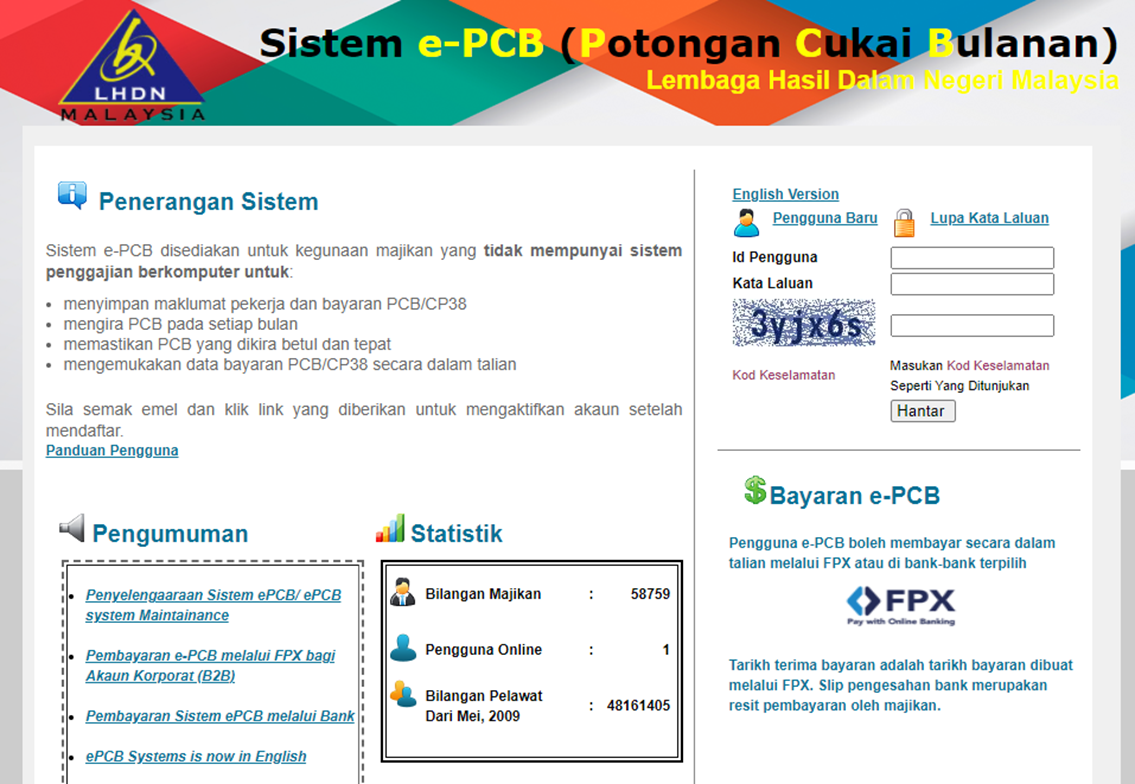

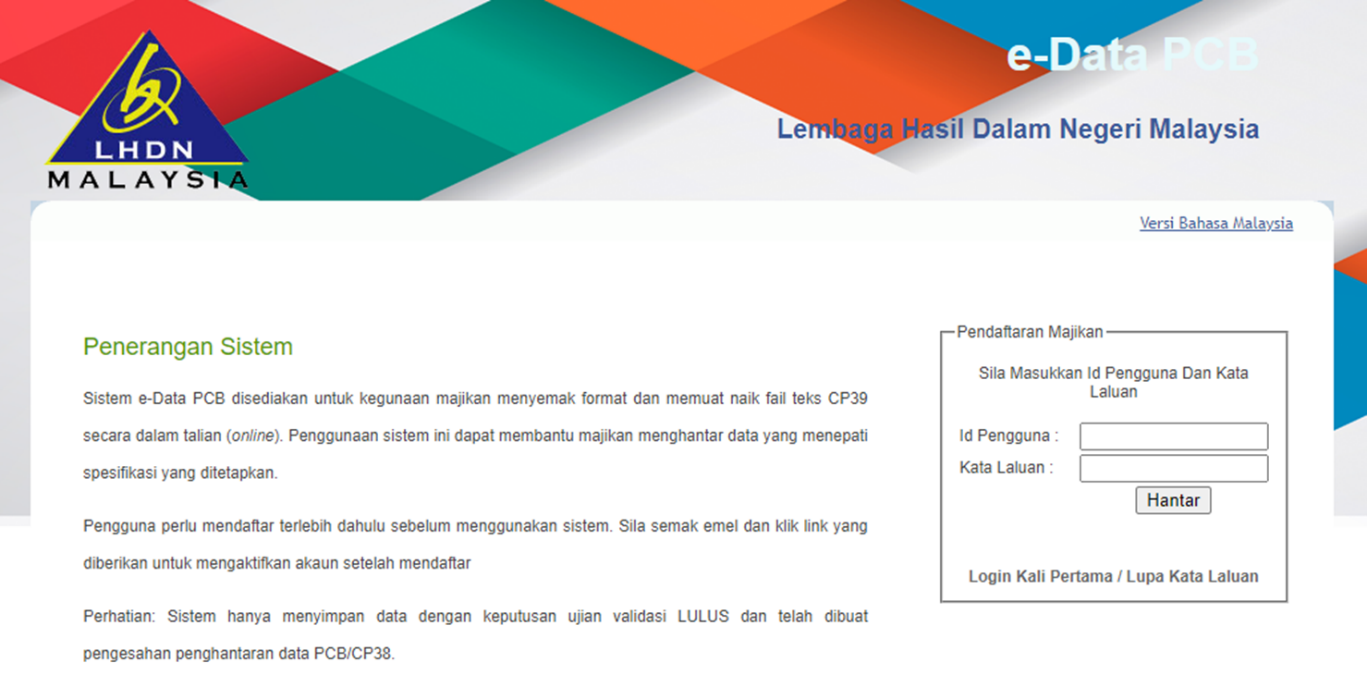

什么是 e-PCB ?e-Data PCB ?e-CP39 ?

什么是 e-PCB ?e-Data PCB ?e-CP39 ?

e-CP39

适合不需要每个月申报PCB的公司使用。无需申请账号亦可直接使用。

e-PCB

适用于没有薪资系统 (Payroll System) 的公司使用。雇主需要申请账号方可以此方式申报PCB。

e-Data PCB

适用于有薪资系统 (Payroll System)的公司使用,通过薪资系统的PCB文档上载申报即可

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

What is solvency test in dividend distribution?

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

Real Property Gain Tax vs Income Tax on Gain on disposal of property/land

Gain on disposal of land – RPGT or Income Tax??

Let’s understand from a Real tax case: KST vs KETUA PENGARAH HASIL DALAM NEGERI

What is this case study?

KST sold a land to a developer company, amounting to RM1,520,000.00. IRB argued the disposal of land is subject to Income Tax Act 1967 (ITA).

KST did not agree

- Initial intention is to distribute land to 9 siblings and no intention for trade purpose.

- After that, KST dispose the land when KST received an offer from developer.

So, the gain from disposal of land is not subject to ITA1967.

What is IRB argument?

- The initial intention has changed.

- The holding period is short.

- KST is one of the director of land acquired company.

- Improvement on land is done before the disposal.

So, the gain from disposal of land is subject to Income Tax Act 1967 (ITA1967).

Decision by Special Commissioners of Income Tax:

Special Commissioner agreed with IRB tax treatment. Gain from disposal of land is subject to Section 4(a) ITA 1967.

What is the difference between RPGT and ITA?

The main difference is the “tax rate”. Let’s see the comparison as follows (tax rate for year of assessment 2020):

For individual (resident):

Income tax : Graduated rate from 0% to 30%

RPGT

- Disposal within 3 years from date of acquisition - 30%

- Disposal in the 4th years from date of acquisition - 20%

- Disposal in the 5th years from date of acquisition - 15%

- Disposal in the 6th years from date of acquisition - 5%

For company (resident)

Income tax

- 17% on the first RM600,000.00 of chargeable income*

- 24% on the subsequent balance of chargeable income

*Resident company with paid up capital of RM2.5 million and below at the beginning of the basis period and having gross income from source or sources consisting of a business not more than RM50 million for the basis period for a year of assessment.

RPGT

- Disposal within 3 years from date of acquisition - 30%

- Disposal in the 4th years from date of acquisition - 20%

- Disposal in the 5th years from date of acquisition- 15%

- Disposal in the 6th years from date of acquisition - 10%

How to determine the disposal is subject to RPGT or ITA?

The badges of trade should be considered:

- Method of acquisition of real property - How was the property acquired? For example, inheritance, through open market or auction.

- Nature of the real property - Whether the property is generating rental income or left for vacant?

- Number of transactions - Frequent transaction is likely to indicate trading of properties and subject to income tax.

- Profit seeking motive - Intention of making profit will be subject to income tax.

- The period of ownership - How long was the property held before disposal?

- Alteration, modification or improvement made to the real property - Renovation or improvement of property before disposal may be viewed as effort to enhance the value of the property, it may subject to income tax.

- Source of financing - How was the purchase of property financed? Short-term or long term borrowing?

- Circumstances surrounding the sale - What were the circumstances leading to the sales of property? Was the property sold because of realise profit or emergency need of funds?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Shareholders' defence on excess distribution

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Who to recover the excess distribution

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Latest development on filing CP 21 & CP 22A online.

Latest development on filing CP 21 & CP 22A online.

Following our first sharing of E-SPC on CP forms on 19/1/2021, it appear some LHDN's branches in Malaysia

1️⃣Stop submission via E-SPC online

2️⃣Stop submission via email.

What is your current practice in your location? Care to share?

Look like LHDN mandatory choice of CP form submission over the counter physically.

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.